Credit Cards

Your Ticket to Shopping Rewards: Woolworths Gold Credit Card review

Explore the gold standard of credit cards for Woolworths shoppers. Earn cash back and enjoy exclusive perks - keep reading and learn more!

Advertisement

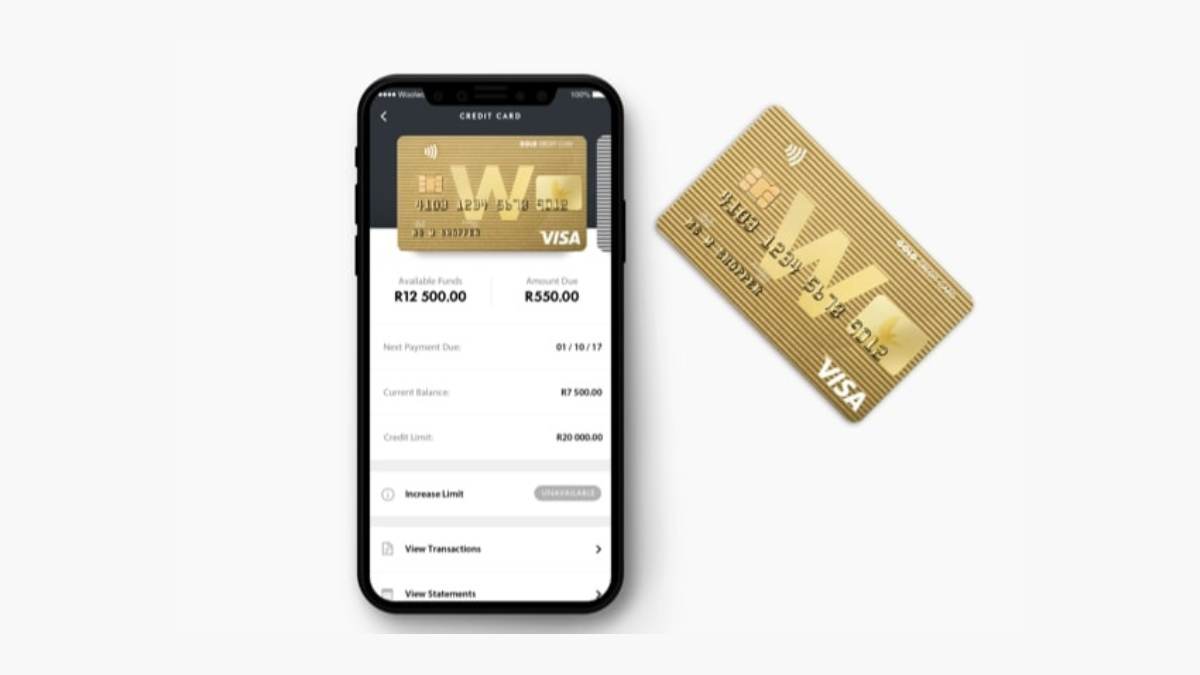

Enhance Your Shopping Experience with the Woolworths Gold Credit Card

If you’re a frequent shopper at Woolworths, the Woolworths Gold Credit Card might be the perfect fit for you – and this review will show you why!

Up to 2% cash back: Apply for Woolworths Gold Card

Ready to maximize your shopping experience? Learn how to apply for the Woolworths Gold Credit Card and start earning exclusive rewards.

Join us as we dive into this card’s features, perks, and potential drawbacks. Earn rewards on your everyday purchases!

| Min Monthly Income | R3,000; |

| Initiation Fee | R193,00; |

| Monthly Fee | R57,00; |

| Interest Rate | 55 days of interest-free. After this period, the interest rate can go up to 21%; |

| Rewards | 2% of your purchase will come back to you as URewards. |

Woolworths Gold Credit Card overview

Are you a frequent shopper at Woolworths? If so, you’ll want to hear about the amazing benefits of the Woolworths Gold Credit Card.

With its fantastic rewards program, every eligible purchase you make earns you valuable Woolworths Rewards Points.

Imagine redeeming these points for discounts on groceries, savings on fuel, and even exclusive offers!

But that’s not all – the card also offers accelerated points earning on select purchases made at Woolworths stores.

And that’s not the end – the Woolworths Gold Credit Card may also come with additional travel benefits, competitive interest rates, and fees.

You will be redirected to another website

Woolworths Gold Credit Card main features

Understanding the benefits and potential drawbacks of a financial product allows you to make an informed choice.

In this spirit, let’s look at the Woolworths Gold Credit Card and review its pros and cons.

Pros

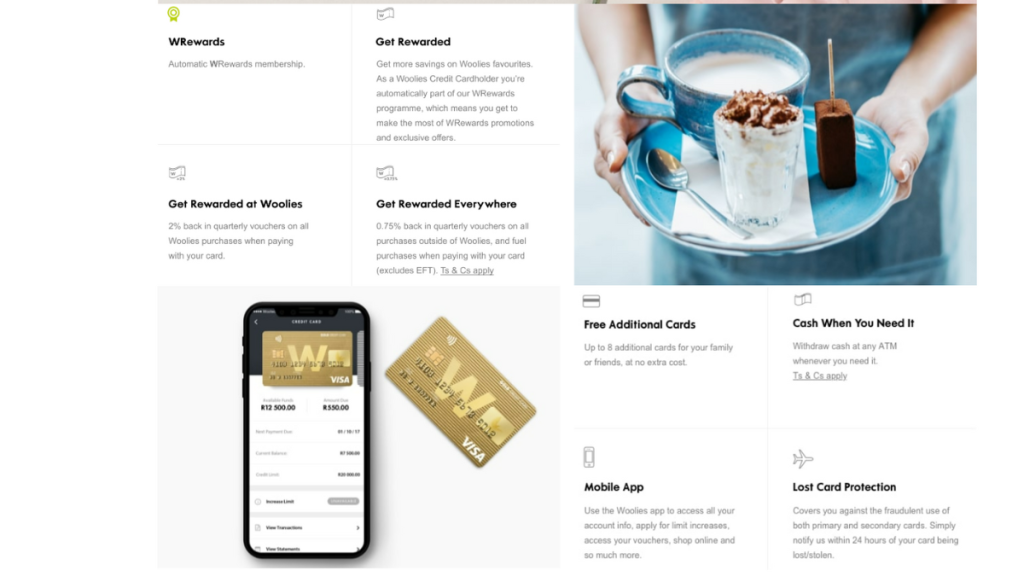

- Rewards Program: The Woolworths Gold Credit Card offers a robust rewards program, allowing cardholders to earn 2% in Woolworths Rewards Points on eligible purchases. These points can be redeemed for discounts on groceries, fuel savings, and exclusive offers;

- Travel Benefits: The card may come with travel benefits such as complimentary travel insurance, providing added value and peace of mind when you’re on the go;

- Competitive Interest Rates and Fees: Woolworths aims to provide competitive interest rates and fees for its Gold Credit Card, helping you manage your finances effectively;

- Purchase Protection and Extended Warranty: Depending on the specific terms and conditions, cardholders may enjoy purchase protection and extended warranty on eligible purchases, providing additional peace of mind and financial security;

- Exclusive Offers: The Woolworths Gold Credit Card may provide access to exclusive offers and promotions, enhancing your overall shopping experience.

Cons

- Limited Benefits Outside of Woolworths: If you don’t frequently shop at Woolworths or prefer to shop elsewhere, the card’s rewards structure may not be as beneficial for you;

- Responsible Credit Card Usage: As with any credit card, it’s essential to practice responsible usage to avoid accumulating debt and paying unnecessary interest charges. This applies to the Woolworths Gold Credit Card as well;

- Potential for Interest Charges: If you carry a balance on the card, you may incur interest charges, which can add to your overall cost. It’s important to manage your credit card balance diligently.

Requirements needed to apply

The requirements to apply for the Woolworths Gold Credit Card are the following:

- First of all, you must be at least 18 years old;

- Secondly, you must be able to provide a valid South African ID and have proof of residence;

- Regarding your financial information, you must provide your bank statements from the last 3 months, so Woolworths can assess your monthly income and determine your creditworthiness.

How to apply for the Woolworths Gold Credit Card?

Now that you know everything about the Woolworths Gold Credit Card from our full review, you can now decide if you want to apply for the card.

The following link will take you straight to our application guide. So don’t waste any more time and apply to start earning 2% cashback on your purchases.

Up to 2% cash back: Apply for Woolworths Gold Card

Ready to maximize your shopping experience? Learn how to apply for the Woolworths Gold Credit Card and start earning exclusive rewards.

About the author / Julia Bermudez

Trending Topics

How to make money fast in South Africa?

Are you in South Africa and wondering how you can make money fast? This post has the answer you’re looking for, so read on!

Keep Reading

Choose your loan: fast and affordable options tailored for you

Learn how to choose a loan that meets all your needs and expectations. Ensure the money you need fast! Read our article now!

Keep Reading

Hoopla Loans: all you need to apply

If you're looking for a loan and want to find the best lenders and offers, check out how to apply for Hoopla Loans! Up to R250,000!

Keep ReadingYou may also like

TFG (The Foschini Group): up to R600,000 annually

Would you like to know how to land a job at TFG? Check out this article and discover how to make it easy and quick!

Keep Reading

How to apply for a job at Checkers: Competitive pay!

Discover how to apply for a job at Checkers. Unlock opportunities, join a dynamic team, and embark on a rewarding retail career journey.

Keep Reading

MG CashViza Prepaid Debit Card: how to apply

Apply for the MG CashViza Prepaid Debit Card today and make the most of your next trip! Use 24 different currencies! Keep reading and learn!

Keep Reading