Credit Cards

Apply for the Zable Credit Card: Build credit

Apply for the Zable Credit Card stress-free with our detailed guide. Say goodbye to fees and embrace a seamless financial experience today!

Advertisement

Apply for the Zable Credit Card: Pre-qualification!

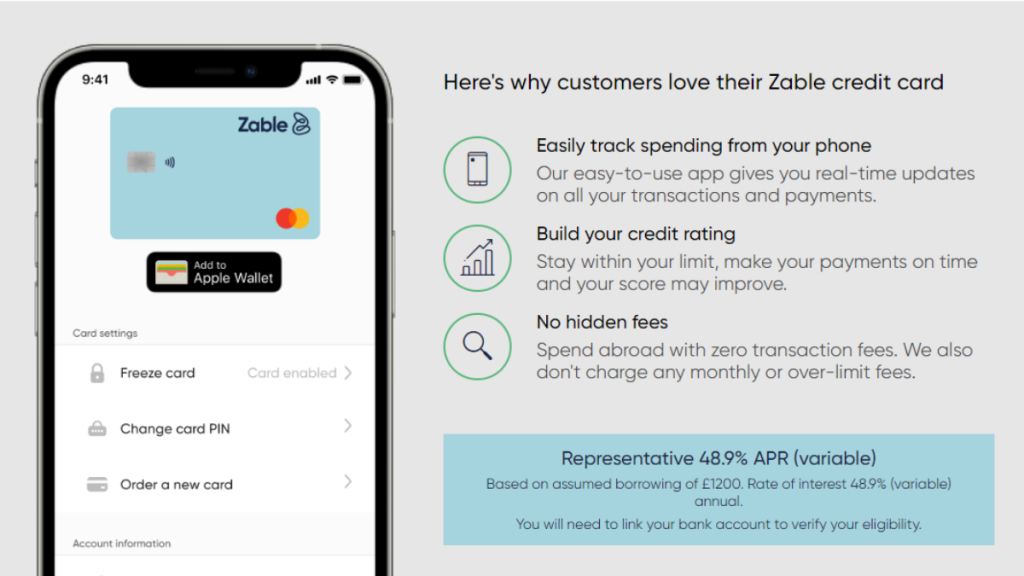

Looking for a credit card that offers flexibility and convenience without the usual fees? Learning how to apply for the Zable Credit Card might be the answer.

Also, applying for a credit card can often feel like navigating a maze, but with Zable, the process is streamlined and straightforward.

Apply for the card: Online

Before you start applying for this card, you should remember some of its best features.

You will be redirected to another website

Card features

So, this credit card can offer incredible features to its users. Also, you won’t need to pay any fees when using this card!

Furthermore, Zable’s commitment to customer service is highlighted through its app notifications.

Also, users receive instant alerts when they become eligible for a credit limit increase.

This ensures that they stay informed about their financial options and empowering them to make well-informed decisions about their spending.

Tips to apply

Therefore, we can show you what you need to learn to apply for this incredible card.

So, you’ll need to go to the official website and choose the financial product you want from Zable.

Then, you’ll be able to start the application process online by providing the personal information required.

After that you’ll be able to find that you’ll receive a quick response on your application!

Apply for the card: Mobile App

You’ll be able to use this card’s mobile app to manage all your finances.

However, you’ll need to complete the application process online to get this card!

Therefore, you can check out our topic above to learn how to apply online for this great card!

Zable Credit Card or HSBC Classic Credit Card?

If you’re looking for other credit card options, you can try applying for the HSBC Classic Credit Card!

Moreover, with this card, you’ll be able to get offers and discounts with HSBC partners and much more!

Also, you’ll be able to apply for this card even with a low credit score! In addition, you’ll be able to get all these perks for no annual fee!

So, check out the comparison table below to learn more about this incredible card and see which is the best option for your needs!

| Zable Credit Card | HSBC Classic Credit Card | |

| Annual Fee | No annual fee; | Applicants can have a low credit score; |

| Credit Limit | Initial credit limit of £200 and £1,500; | Pay a total of £0 in annual fees for this card; |

| Representative APR | 48.90% variable APR; | The purchase APR is 29.9% p.a. (variable); |

| Purchase Rate | N/A; | For cash advances, you must pay 35.9% p.a. (variable); |

| Welcome Bonus | No welcome bonus; | As a basic credit card, it has no kind of bonus for new cardholders; |

| Rewards | None. | This is not a rewards credit card, but you can get offers for discounts with HSBC partners. |

So, if you love the features of the HSBC Classic Credit Card, you can read our blog post below to learn more and see how to apply!

HSBC Classic Credit Card: how to apply

Looking for a way to apply for the HSBC Classic Credit Card? You’ve just found the perfect application guide. Up to £1,000 credit limit!

About the author / Victoria Lourenco

Trending Topics

Lifestyle Personal Loans review: no hidden fees!

Are you on the quest for the best personal loan in the Uk? Read this Lifestyle Personal Loans review to see if this is the one! Up to £5,000!

Keep Reading

Capital One Balance Transfer Card review: No annual fee!

Discover in the Capital One Balance Transfer Card review if this is your ticket to managing debts efficiently! 0% intro interest!

Keep Reading

Vanquis Bank Chrome Credit Card review: £0 annual fee

If you’re looking for a credit builder card, read this Vanquis Bank Chrome Credit Card review! Enjoy up to 56 days of interest-free period.

Keep ReadingYou may also like

Bamboo Personal Loans: all you need to apply

Do you need extra financial support? Check how to apply for Bamboo Personal Loans. Up to £8,000 and a fast process! Keep reading and learn!

Keep Reading

Minty Personal Loans review: borrow up to £3,000

Do you need a loan with flexible repayment plans? Check our Minty Personal Loans review. Qualify with poor credit and pay no hidden fees!

Keep Reading

Barclaycard Forward Card: how to apply

Looking for a credit card that builds your credit? Then apply for Barclaycard Forward Card! 0% interest on purchases for 3 months! Read on!

Keep Reading