Credit Cards

Marbles Credit Card review: No annual fee!

Exploring the Marbles Credit Card: Dive into its perks, potential drawbacks, and suitability for various credit needs. Make an informed choice for your financial journey!

Advertisement

Marbles Credit Card review: Build your score!

In the world of credit cards, finding the right fit can feel like discovering a hidden gem. Enter the Marbles Credit Card review!

Apply for the Marbles Credit Card

Discover the steps to apply for the Marbles Credit Card! Master the application process and empower your financial journey today!

Also, this is an offering that aims to cater to a diverse audience, from those looking to rebuild their credit without annual fees!

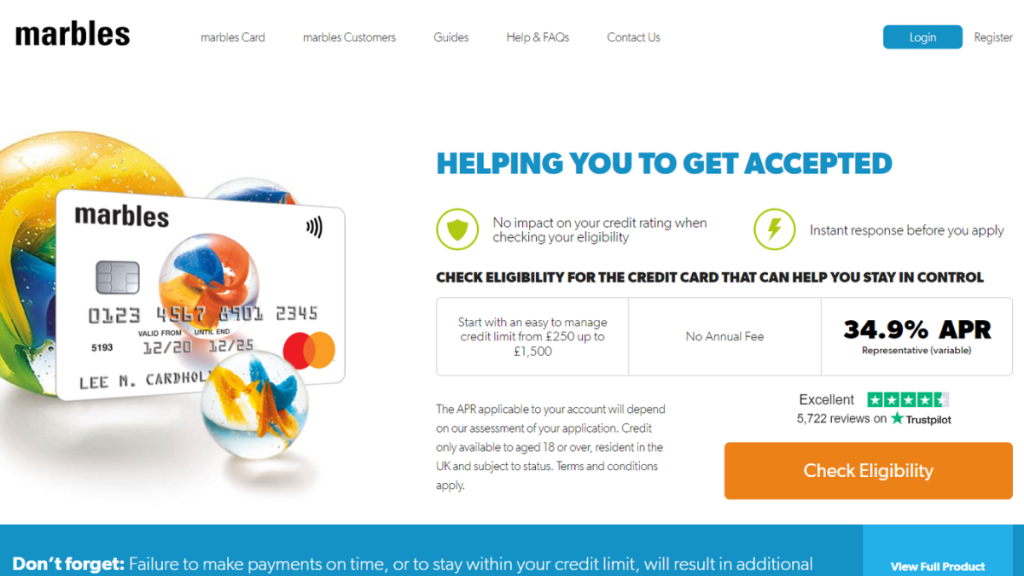

| Annual Fee | There is no annual fee; |

| Credit Limit | Initial credit limit from £250 up to £1,500; |

| Representative APR | 34.9% representative variable APR; |

| Purchase Rate | 34.9% representative for purchases; |

| Welcome Bonus | No welcome bonuses; |

| Rewards | No rewards program. |

Marbles Credit Card overview

In this comprehensive review, we’ll delve into the intricacies of the Marbles Credit Card.

Exploring its strengths and limitations and how it stacks up against the competitive landscape of credit options.

Indeed, this credit card can be an ally to your credit-building journey while offering an amazing credit limit of up to £1,500!

You will be redirected to another website

Marbles Credit Card main features

With its emphasis on aiding users in their credit-building journey, the Marbles Credit Card stands out as a viable choice for those wanting to take charge of their financial future.

So, check out this card’s pros and cons below!

Pros

This card offers incredible features to its users. Therefore, check out the main pros below!

Qualify with poor credit

The Marbles Credit Card offers a path to qualifying for people with poor credit as well.

Therefore, people with bad credit records can now apply for credit cards as a result of this inclusion, which may allow them to utilize credit responsibly to improve and rebuild their credit.

Moreover, what sets it apart is its inclusivity, which encourages accessibility and financial empowerment for a larger range of customers.

No annual fee

One of the Marbles Credit Card’s noteworthy features is the lack of an annual fee.

Moreover, customers may benefit from the card’s features without having to pay extra annually thanks to its alluring fee-free structure.

56 days interest-free

The credit card provides a substantial 56-day interest-free period on purchases as long as the balance is paid in whole and on time each month.

Improve your credit score

The Marbles Credit Card is an excellent instrument for raising your credit score when utilized sensibly.

Also, by using this card responsibly and making on-time, consistent payments, users may show lending institutions that they are reliable.

Cons

Although this card offers incredible perks, it also has some downsides to it. So, read the main ones below!

Lack of rewards

Even with all of the Marbles Credit Card’s benefits, it’s important to remember that its absence of rewards or exclusive deals makes it less desirable than other credit cards.

Relatively low initial credit limit

The Marbles Credit Card’s initial credit limit, which ranges from £250 to £1,200 based on the applicant’s creditworthiness, is another potential disadvantage.

Interest-free period with terms

It’s crucial to keep in mind that although the card offers a fantastic interest-free period on purchases, this benefit does not apply to cash transactions or installment plans.

Minimum credit score to apply

You’ll be able to have a chance to qualify for this card even with a poor credit score.

Moreover, you’ll be able to see if you pre-qualify with no credit score harm and no costs!

How to apply for the Marbles Credit Card?

You can easily apply for this card with no annual fee! So, read our blog post below to learn more about this card and find out how the application process works!

Apply for the Marbles Credit Card

Discover the steps to apply for the Marbles Credit Card! Master the application process and empower your financial journey today!

About the author / Victoria Lourenco

Trending Topics

Koyo Personal Loans: all you need to apply

Take a look at this blog post and discover how easy it is to apply for Koyo Personal Loans. Borrow up to £12,000 in no time! Read on!

Keep Reading

10 Top Secret Websites to Make Money Online

Ready to uncover the hidden gems of online earning? Delve into our post unveiling top-secret websites to make money online!

Keep Reading

Barclaycard Forward Card: how to apply

Looking for a credit card that builds your credit? Then apply for Barclaycard Forward Card! 0% interest on purchases for 3 months! Read on!

Keep ReadingYou may also like

Post Office Money Classic Credit Card review

A credit card with £0 annual fee and 0% intro APR to build credit exists. Check this Post Office Money Classic Credit Card review!

Keep Reading

TSB Platinum Balance Transfer Card review: No annual fee!

Discover the pros and cons of the TSB Platinum Balance Transfer Card in our review. Uncover its impressive 0% interest period and more!

Keep Reading

Apply for Halifax Clarity Card: Achieve financial freedom

Learn how to apply for the Halifax Clarity Card effortlessly. From necessary personal information to navigating the application channels!

Keep Reading