Credit Cards

A Step-by-Step Guide: Applying for the ANZ Low Rate Credit Card

Take control of your financial future! Learn how to secure the ANZ Low Rate Credit Card. Simplify your application and unlock cost-effective credit!

Advertisement

Unlocking Financial Freedom: How to Secure Your ANZ Low Rate Credit Card

Are you looking to get your hands pn a new card? You can learn how to apply for the ANZ Low Rate Credit card in an easier way than you might think.

Also, in this guide, we’ll walk you through the process, ensuring you have all the information you need to start enjoying the benefits of this card.

Apply for the card: Online

Applying for the ANZ Low Rate Credit Card is a straightforward process, and we’ll demystify it for you.

Moreover, from gathering essential documents to navigating the online application portal, we’ve got you covered.

So, you can go to the official website and click on apply now on the card you like. Then, you’ll need to provide the personal information required.

After all of that, you’ll be able to send the personal documents required and complete the application process to get a quick response.

You will be redirected to another website

Apply for the card: Mobile App

You can use the ANZ mobile app to manage all your financial products with ANZ.

However, you’ll need to start and complete the application process through the official website online!

ANZ Low Rate Credit Card or Westpac Low Rate Card?

If you’re not so sure about getting the ANZ Low Rate Card, we can help you with a different option. So, you can try applying for the Westpac Low Rate card!

Also, with this card, you’ll be able to get a good credit limit of up to $500, depending on your credit score and finances.

Moreover, you’ll be able to get cashback and a balance transfer offer as a new cardholder of this incredible card.

Plus, you’ll get 55 days interest-free and a very low purchase rate of 13.74% variable rate!

So, you can read the comparison table below to learn more and see which can be the best option for your needs.

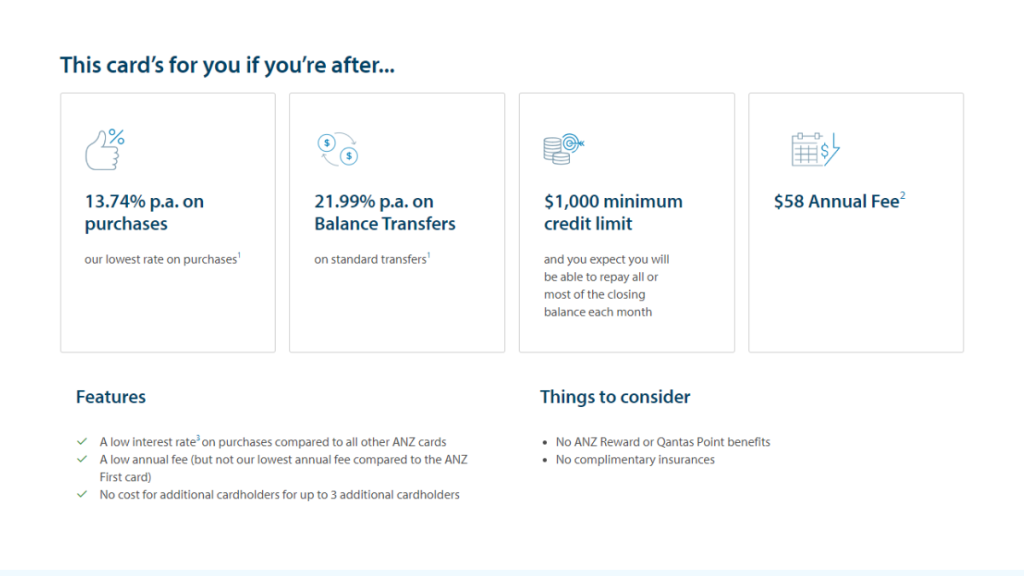

| ANZ Low Rate Credit Card | Westpac Low Rate Card | |

| Annual Fee | $0 annual fee on the first year as a new cardholder. Then, a $58 annual fee; | $59 ongoing annual fee; |

| Purchase Rate | 13.74% p.a. on purchases; 21.99% p.a. on balance transfers (valid for standard transfers); | 13.74% p.a. variable purchase rate; |

| Interest-Free Period | 0% p.a. on balance transfers for a 28-month promotional period for new cardholders; Up to 55 interest-free days on purchases; | 55 days interest-free; |

| Minimum Credit Limit | $1,000 minimum credit limit; | You’ll find a minimum credit limit of $500, depending on your finances; |

| Credit Score | Good credit rating; | You’ll need a reasonable credit score to have more chances to qualify for this credit card; |

| Rewards | You can earn cashback from over 2,000 popular retailers when shopping through Cashrewards. | No rewards besides the cashback offer or the balance transfer offer. |

So, if you love the features of Westpac Low Rate, you can read our blog post below to learn all about how the application process works for this card!

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

About the author / Victoria Lourenco

Trending Topics

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

Keep Reading

Apply for HSBC Low Rate Card: Unlocking Financial Freedom

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Learn the step-by-step application process!

Keep Reading

Apply for ANZ First Credit Card: Your Key to Financial Freedom

Learn the easy steps to apply for the ANZ First Credit Card. Enjoy $0 annual fee in the first year, plus amazing cardholder benefits!

Keep ReadingYou may also like

How to Make Money Online: 10 Proven Strategies

Find out how to make money online in the UK! Explore affiliate marketing, freelancing, digital products, ad monetization, and more!

Keep Reading

Budget-Friendly and User-Focused: St.George Vertigo Card review

Read this St.George Vertigo Card review for a look at its pros, cons, and whether it's the right fit - ensure an interest-free period!

Keep Reading

ANZ First Credit Card Review: Smart Financial Choices

Explore the ANZ First Credit Card's benefits and limitations in our detailed review. $0 annual fee in the first year! Read on and learn more!

Keep Reading