Loans

Apply for Citrus Loans: Up to $2,500!

Looking for payday loans to meet your financial needs? If so, read on to learn how to apply for Citrus Loans! Quick and simple process!

Advertisement

Seamless Financing Made Easy: Apply for Citrus Loans!

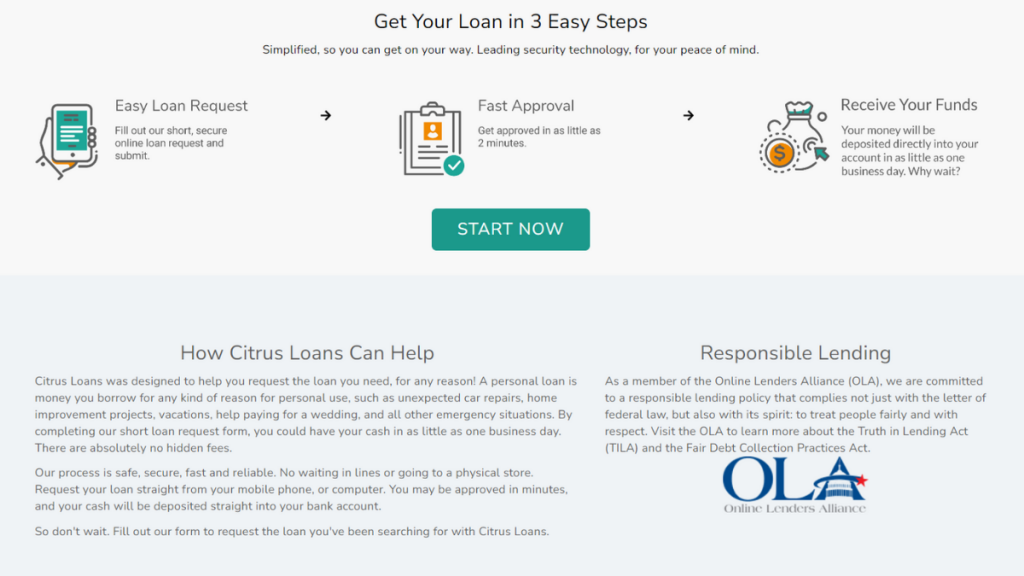

Are you in need of financial assistance to achieve your goals? If so, you can read on to learn how to apply for Citrus Loans!

Moreover, applying for a loan can be a daunting task, but Citrus Loans is here to make it simpler and more accessible than ever before. So read on!

Apply for the loan: Online

You can apply for a loan through this lender online on the official website.

Moreover, you’ll need to provide the personal information required.

Then, you’ll be able to wait and get your response. Also, you’ll be able to get your funds fast with a quick response.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

You’ll need to meet the requirements to apply for a loan through this platform.

Therefore, you’ll need to be at least 18 years old, have a checking account, and more.

Also, you’ll need to have a checking account and a regular job with a minimum income.

Moreover, the requirements can vary depending on the lender you find through the platform!

Apply for the loan: Mobile App

You can use the mobile app to manage your loan funds. However, you won’t be able to apply for a loan through the app.

This way, you’ll need to follow our tips on the topic above to apply for a loan online.

Citrus Loans or LendingClub Personal Loans?

If you’re not looking for a loan from Citrus Loans, you can try applying for a loan through a different lender.

Also, for example, you can try applying for a loan through LendingClub Personal Loans.

Moreover, with this platform, you’ll be able to get loan amounts of up to $40,000.

Moreover, you’ll be able to get loans for many personal purposes. However, you’ll need a higher credit score to have more chances.

So, read our comparison table below to learn more!

| Citrus Loans | LendingClub Personal Loans | |

| APR | From 261% to 1304% variable APR; | APR ranges from 8.05% to 36.00%; |

| Loan Purpose | Payday loans for various personal purposes; | Credit card and debt consolidation, balance transfers, medical bills, home improvements, and more; |

| Loan Amounts | From $500 to $2,500; | You can apply for loans from $1,000 to $40,000; |

| Credit Needed | All credits are considered during the application process; | Borrowers with fair to excellent credit can get one; |

| Terms | From 14 days to 24 months; | From 36 to 60 months (or 3 to 5 years); |

| Origination Fee | There can be origination fees depending on your loan type and lender; | From 2.00% to 6.00% of the loan amount; |

| Late Fee | There will be late fees if you don’t make your loan repayments on time; | There can be late fees if you don’t make your payments on time; |

| Early Payoff Penalty | There are no prepayment fees for this lending platform. | You won’t need to pay any prepayment fees. |

Therefore, now you can read our post below to learn more about LendingClub Personal Loans and how to apply for it!

LendingClub Personal Loans: all you need to apply

Learn now how to apply for a LendingClub Personal Loans. Qualify with fair credit and enjoy personalized rates! Keep reading for more!

About the author / Victoria Lourenco

Trending Topics

1.5% cash back: Capital One QuicksilverOne Cash Rewards review

Did you know you can build credit with a rewards card? Check this Capital One QuicksilverOne Cash Rewards review and understand how it works.

Keep Reading

What credit score do you need to lease a car?

Check if you have the credit score needed to lease a car. It can be better than buying one. Read on, and you’ll see how it works.

Keep Reading

SmartFundSolutions review: up to $5,000

Discover the ins and outs of SmartFundSolutions in our review. Ensure no hidden fees and flexible conditions! Keep reading!

Keep ReadingYou may also like

Happy Money Loans review: Your Gateway to Smart Borrowing

Do you need a good loan provider? If so, get the lowdown on their services in our Happy Money Loans review! Up to $40,000 quickly!

Keep Reading

Chase Sapphire Preferred® credit card review

Check out this Chase Sapphire Preferred® review to learn all the features, pros and cons of this fantastic credit card.

Keep Reading

OpenSky® Plus Secured Visa® Credit Card review

Don't let a lack of credit history hold you back. Explore our OpenSky® Plus Secured Visa® Credit Card review.

Keep Reading