Credit Cards

Apply for the Fluid Credit Card: quick application

Applying for the Fluid Credit Card made easy: Navigate the application process effortlessly with our guide, outlining the steps and essential considerations for a successful application!

Advertisement

Apply for the Fluid Credit Card: Easy application

Unlocking financial flexibility often begins with choosing the right credit card, and the Fluid Credit Card offers a suite of features tailored to meet diverse financial needs.

Also, we’ll walk you through the process of applying for the Fluid Credit Card. Therefore, keep reading to learn more about how to apply for this card!

Apply for the card: Online

Whether you’re eyeing the enticing balance transfer offers or seeking a card with flexible payment options, this guide will help you.

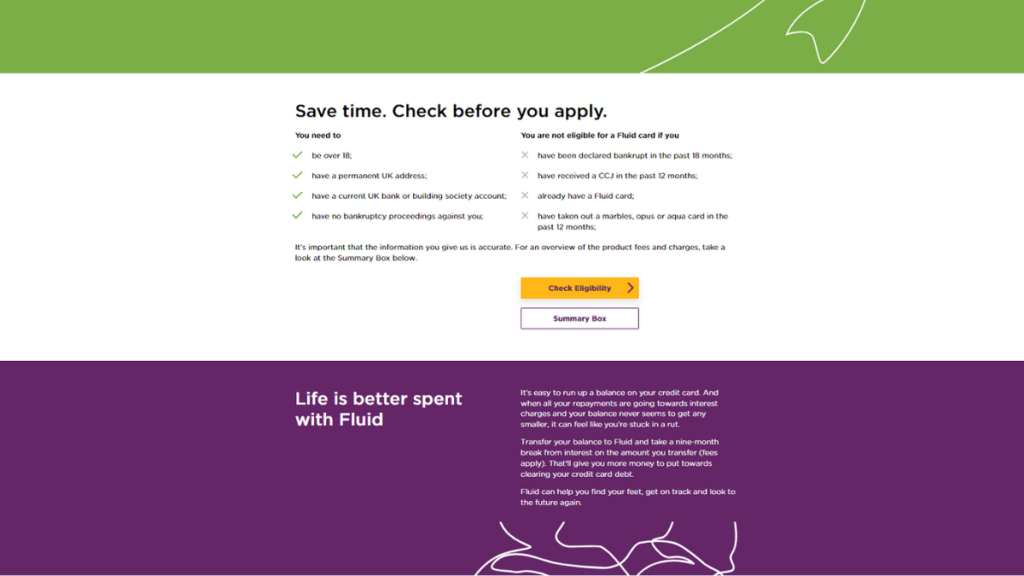

So, to apply for the Fluid Credit Card, you’ll need to access the card’s official website. Next, hit the “Check Eligibility” button to get started!

There, you’ll fill out the application form with your information, including name, contact and address. Once done, submit the form.

Wait for the result, it is quick and simple. If approved, follow the instructions to get your Fluid Credit Card!

You will be redirected to another website

Eligibility

You’ll need to be at least 18 years old and have a permanent UK address. Moreover, you can’t have any CCJs in the past 12 months.

Also, the minimum income for this card can be high. So, you’ll need to earn at least £5,000 as a minimum monthly income.

So, there can also be more requirements. However, you’ll need to check the official requirements before you start the application process!

Apply for the card: Mobile App

You’ll be able to use the Fluid mobile app to manage your finances and all your credit card features.

However, you’ll need to apply online. So, check out our topic above to learn more about the online application.

Fluid Credit Card or Zopa Credit Card?

Are you not so sure about getting the Fluid Card? If so, we can help! So, you can start applying for the Zopa Credit Card!

Moreover, with this card, you’ll be able to get incredible features, such as no annual fee and up to a £2,000 credit limit!

Also, this card has a good acceptance for those with low scores to help you build your credit.

Therefore, check out our comparison table below to see which card can be the best option for your finances at the moment!

| Fluid Credit Card | Zopa Credit Card | |

| Annual Fee | There is no annual fee; | Not disclosed, but as a credit-builder card, it must accept applicants with low scores; |

| Credit Limit | Initial credit limit of £250-£4,000; | You won’t have to pay even a penny for this card in monthly or annual fees; |

| Representative APR | 34.90% variable APR; | Variable 34.9%; |

| Purchase Rate | Representative 34.94% variable purchase rate; | Variable 34.9%; |

| Welcome Bonus | You’ll get 0% interest on balance transfers for your first 9 months using the card (with a 3% fee); *Terms apply; | Unfortunately, no welcome bonus is offered; |

| Rewards | No rewards program. | The Zopa Credit Card offers no rewards. |

So, if you love the features of the Zopa Credit Card, you can read the blog post below to learn more about it and see how you can apply for it!

Zopa Credit Card: how to apply

We’ll tell you how to apply for the Zopa Credit Card, and you’ll see how simple and efficient it is. Pay no annual fee! Read on!

About the author / Victoria Lourenco

Trending Topics

Zable Credit Card review: No annual fee!

Delve into our insightful Zable Credit Card review - no hidden fees and amazing credit-building features! Keep reading and learn more!

Keep Reading

What is a balance transfer credit card?

If you're someone who carries a credit card balance month to month, learn more about what is a balance transfer credit card!

Keep Reading

What is the minimum credit score for a mortgage in the UK?

If you want to buy and know what is the minimum credit score for a mortgage in the UK, don't worry! We'll explain everything you need!

Keep ReadingYou may also like

Apply for the HSBC Balance Transfer Credit Card: Amazing discounts

Find out how to apply for the HSBC Balance Transfer Credit Card! Our blog post covers everything you need to know to get this great card!

Keep Reading

Minty Personal Loans: all you need to apply

Are you looking for an easy application and no additional costs? Learn how to apply for Minty Personal Loans! Up to £3,000!

Keep Reading

Apply for the TSB Platinum Purchase Card: Intro 0% interest

Learn how to apply for the TSB Platinum Purchase Card with our step-by-step guide. Save on purchases and balance transfers!

Keep Reading