Credit Cards

Simplicity Meets Savings: Apply for the St.George Vertigo Card

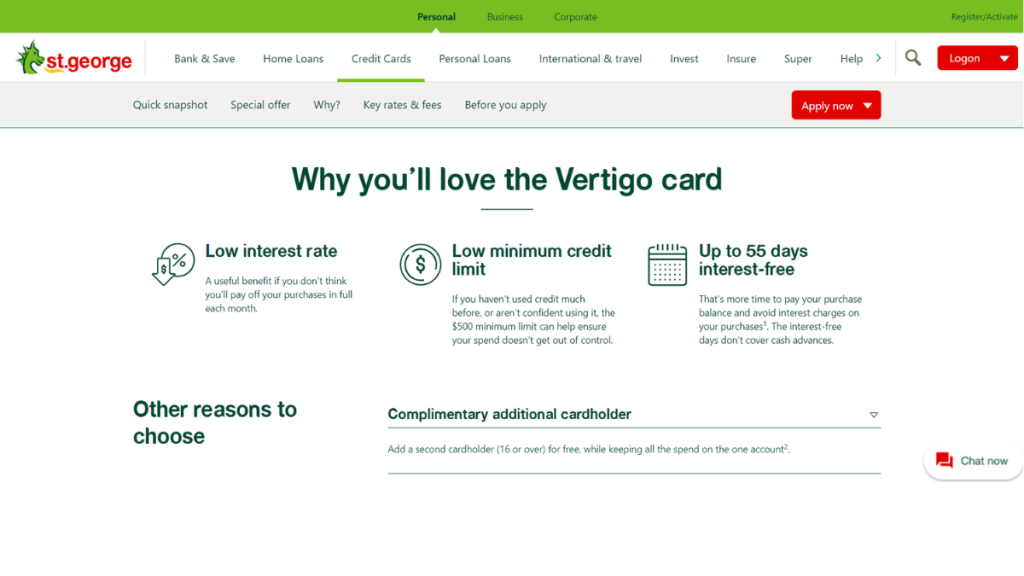

Navigate the process effortlessly with our guide on applying for the St.George Vertigo Card. Discover a card that's as straightforward as it is practical!

Advertisement

Your Guide to Financial Ease: Applying for the St.George Vertigo Card

Learning how to apply for the St.George Vertigo Card is your ticket to a seamless and cost-effective financial journey.

Also, if you’re on the hunt for a card that’s easy to understand, offers competitive rates, and provides a practical solution for everyday spending.

Apply for the card: Online

You can easily apply for this card online through the official website.

Moreover, you’ll be able to choose between the cash-back offer or the balance transfer offer.

Then, you’ll need to read the terms and conditions to use this card.

After all of this, you can provide the personal information required during the application process.

Then, you’ll be able to complete the application process and wait for a quick response!

You will be redirected to another website

Apply for the card: Mobile App

You can use the St.George mobile app to manage all your St.George accounts and credit and debit cards!

Moreover, you’ll be able to use this app to access the 24/7 virtual assistant and much more!

Also, you can download the app through the official page on the app store of your phone.

However, you can only apply for this card online through the official website. Therefore, you can read our topic above to see our tips!

St.George Vertigo Card or Westpac Low Rate Card?

If the St.George Vertigo Card is not what you’ve been looking for, we can help you find a different option! So, try applying for the Westpac Low Rate.

Also, with this card, you’ll be able to get 55 days interest-free! Also, you’ll be able to get a credit limit of at least $500!

Moreover, you can get a 0% intro p.a. for up to 28 months on qualifying balance transfers! Moreover, you won’t need to pay any fees for this type too!

However, this offer is only valid for those who are new cardholders.

Therefore, you can read the comparison table below to learn more about these cards and see which one has the best features for your financial needs!

| St.George Vertigo Card | Westpac Low Rate Card | |

| Annual Fee | There is a $55 annual card fee. | $59 ongoing annual fee; |

| Purchase Rate | 13.99% p.a. variable interest rate on purchases. | 13.74% p.a. variable purchase rate; |

| Interest-Free Period | Up to 55 days interest-free. | 55 days interest-free; |

| Minimum Credit Limit | You can get a $500 minimum credit limit. | You’ll find a minimum credit limit of $500, depending on your finances; |

| Credit Score | You’ll need a good credit score and your finances in good standing to have more chances to qualify for this card. | You’ll need a reasonable credit score to have more chances to qualify for this credit card; |

| Rewards | You can choose between the cash back perks card option and the balance transfer features discount option. | No rewards besides the cashback offer or the balance transfer offer. |

So, if you love the features of the Westpac Low Rate Card, you can learn how to apply for it!

Therefore, read our blog post below to learn more about this card and see how the application process works!

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

About the author / Victoria Lourenco

Trending Topics

ANZ First Credit Card Review: Smart Financial Choices

Explore the ANZ First Credit Card's benefits and limitations in our detailed review. $0 annual fee in the first year! Read on and learn more!

Keep Reading

Westpac Low Rate Card review: Is it Worth It?

Is this card your ideal financial companion? Read on to find out in our Westpac Low Rate Card review! Up to 55 interest-free days!

Keep Reading

ANZ Low Rate Credit Card: A Review of Cost-Effective Card

Discover the features, benefits, and potential savings with our comprehensive ANZ Low Rate Credit Card review! $0 annual fee in the 1st year!

Keep ReadingYou may also like

A Step-by-Step Guide: Applying for the ANZ Low Rate Credit Card

Discover the hassle-free way to apply for the ANZ Low Rate Credit Card with our step-by-step guide. Get the card that helps you save!

Keep Reading

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

Keep Reading

Apply for HSBC Low Rate Card: Unlocking Financial Freedom

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Learn the step-by-step application process!

Keep Reading