Loans

Citrus Loans review: Your Guide to Borrowing

Is Citrus Loans the right lending solution with payday loans for you? Read our Citrus Loans review to see the pros and cons!

Advertisement

Citrus Loans review: The Inside Scoop on Citrus Loans

In a world where financial needs come unannounced, finding the right lending platform can make a difference. So, you can read our Citrus Loans review.

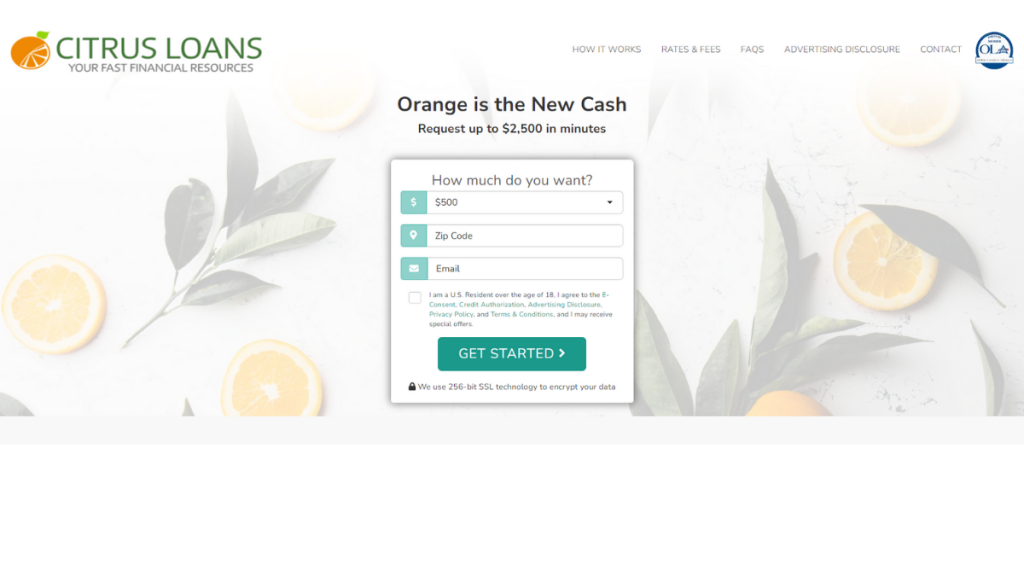

Apply for Citrus Loans: Up to $2,500!

Discover the simplicity of securing your financial future with Citrus Loans. Read on to learn how to apply for Citrus Loans!

Moreover, if you’re on the lookout for a dependable solution, you’re in the right place. Today, we’re delving deep into the Citrus Loans platform!

| APR | From 261% to 1304% variable APR; |

| Loan Purpose | Payday loans for various personal purposes; |

| Loan Amounts | From $500 to $2,500; |

| Credit Needed | All credits are considered during the application process; |

| Terms | From 14 days to 24 months; |

| Origination Fee | There can be origination fees depending on your loan type and lender; |

| Late Fee | There will be late fees if you don’t make your loan repayments on time; |

| Early Payoff Penalty | There are no prepayment fees for this lending platform. |

Citrus Loans details

Citrus Loans is a trusted and user-friendly online platform that connects borrowers with a wide network of reputable lenders.

Moreover, whether you’re looking for a personal loan, a mortgage, or a business loan, Citrus Loans has you covered.

Therefore, in just a few clicks, you can access competitive loan offers tailored to your financial needs and preferences.

Also, Citrus Loans has been making waves in the lending industry, promising a seamless borrowing experience for individuals and businesses alike.

Moreover, you can get payday loans of up to $2,500 with good terms.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Citrus Loans: pros and cons

Even though this platform offers incredible perks and payday loans, it also has some downsides.

Therefore, you can read our pros and cons list below to learn more and see if this is the best platform for your financial needs!

Pros

- There are no prepayment penalties;

- You’ll be able to get up to $2,500 in payday loans;

- There are loans with good terms;

- It can be easy to apply online through the website;

- Reasonable customer support.

Cons

- You’ll need a checking account and employment with a minimum income;

- There is not much information about the origination and late fees online;

- The APR can be really high.

What is the minimum credit score to apply?

You’ll be able to have a chance to apply for a loan with this lender even with a low credit score or no score.

However, you may get incredibly high APR fees that can go up to 1304%!

Therefore, we recommend that you have a higher score before you apply for a loan, credit card, or any other financial product.

However, if you really need a loan, you can have a chance to qualify even with no score.

Citrus Loans: steps to apply

Apply easily for a loan through this platform online and through the website.

However, you’ll need to meet the requirements to register through the platform, and some lenders may have some other requirements depending on your finances.

So, you can read our post below to learn more about the application process for Citrus Loans!

Apply for Citrus Loans: Up to $2,500!

Discover the simplicity of securing your financial future with Citrus Loans. Read on to learn how to apply for Citrus Loans!

About the author / Victoria Lourenco

Trending Topics

The Ultimate Credit Solution for All: Upgrade Card review

Read our review to learn more about the Upgrade Card - $0 annual fee! This is your key to building credit fast! So read on and learn more!

Keep Reading

Credit cards made easy. Get the credit card you deserve and Unlock your credit score potential

Choose a credit card to improve your finances! We’ll show you the best options and show you how to choose one of them.

Keep Reading

Earn up to 5% back: Sam’s Club® Mastercard® review

If you're looking for a credit card that can give you cashback and exclusive perks, check this Sam’s Club® Mastercard® review!

Keep ReadingYou may also like

$0 annual fee: Quicksilver Student Cash Rewards review

Saving money is a great idea when you are a student. Check this Quicksilver Student Cash Rewards review - earn 1.5% cash back on purchases!

Keep Reading

Can you get a credit card with no job?

Is there any chance you can get a credit card with no job? The odds are not the best, but let’s see what you can do.

Keep Reading

$0 annual fee: Apply for Capital One® Walmart Rewards® Card

Love shopping at Walmart? Learn now how to apply for the Capital One® Walmart Rewards® Card - $0 annual fee and reward program!

Keep Reading