Credit Cards

HSBC Low Rate Card: A Review of Savings and Simplicity

Curious about the HSBC Low Rate Card? Learn how this credit card can be your key to managing your finances with ease and affordability!

Advertisement

HSBC Low Rate Card Review: Unlocking Financial Efficiency

Looking for a credit card that offers more savings and less complexity? The HSBC Low Rate Card review might be your answer.

Apply for HSBC Low Rate Card

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Up to 55 interest-free days! Read on!

So, in this comprehensive review, we’ll delve into the key features and benefits of this card to help you make an informed decision!

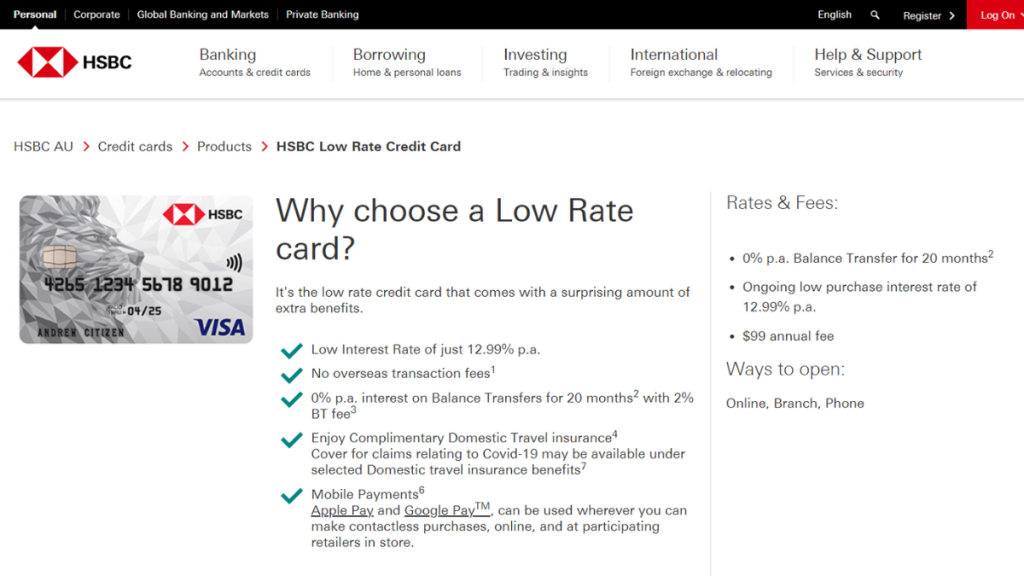

| Annual Fee | $99 annual fee; |

| Purchase Rate* | Ongoing low purchase rate of 12.99% p.a.; 0% p.a. interest on Balance Transfers for 20 months with a 2% BT fee; *Terms apply; |

| Interest-Free Period | Up to 55 days interest-free; |

| Minimum Credit Limit | $1,000 minimum credit limit; |

| Credit Score | You’ll need at least a good credit score to have a chance to qualify for this card; |

| Rewards | There is no reward program for this card. |

HSBC Low Rate Card overview

From its competitive rates to the perks it brings, we’ll explore why the HSBC Low Rate Card has become a popular choice for individuals seeking a low-cost solution to their financial needs.

Moreover, with its 0% p.a. intro rate on balance transfers, this card opens the door to potential savings on interest payments. But that’s just the beginning.

Also, this card offers a low ongoing interest rate on purchases, making it an attractive option for everyday expenses.

The HSBC Low Rate Card boasts features that provide a straightforward and cost-effective credit card experience.

It shines with a remarkable 0% p.a. intro rate for 20 months on balance transfers, making it a great choice for consolidating existing card debt and saving on interest charges.

You will be redirected to another website

HSBC Low Rate Card main features

Even though the HSBC Low Rate Card has incredible features, it has some downsides.

Therefore, read our pros and cons list below to learn more about this card and see if this is the best choice!

Pros

- You’ll pay a 0% p.a. for 20 months on balance transfers as a new cardholder;

- You can get complimentary domestic travel insurance. So, this card can be a great option if you like to travel;

- There is a low ongoing interest rate for purchases;

- There is an easy application process.

Cons

- The balance transfers rever to the cash advance rate;

- High p.a. charged on cash advances;

- There are no rewards programs.

Minimum credit score to apply

Unfortunately, if you have a low credit score, you won’t be able to apply for this card.

So, you must ensure a high score before starting the application process.

Therefore, you’ll need at least a good credit score level to have a chance to qualify for this credit card!

How to apply for the HSBC Low Rate Card?

You can easily apply for this card online through the official website.

Also, you’ll need to make sure you meet the income and other requirements before applying or you apply.

So, read our blog post below to learn how to apply for this card!

Apply for HSBC Low Rate Card

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Up to 55 interest-free days! Read on!

About the author / Victoria Lourenco

Trending Topics

Budget-Friendly and User-Focused: St.George Vertigo Card review

Read this St.George Vertigo Card review for a look at its pros, cons, and whether it's the right fit - ensure an interest-free period!

Keep Reading

A Step-by-Step Guide: Applying for the ANZ Low Rate Credit Card

Discover the hassle-free way to apply for the ANZ Low Rate Credit Card with our step-by-step guide. Get the card that helps you save!

Keep Reading

Apply for HSBC Low Rate Card: Unlocking Financial Freedom

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Learn the step-by-step application process!

Keep ReadingYou may also like

How to Make Money Online: 10 Proven Strategies

Find out how to make money online in the UK! Explore affiliate marketing, freelancing, digital products, ad monetization, and more!

Keep Reading

Apply for ANZ First Credit Card: Your Key to Financial Freedom

Learn the easy steps to apply for the ANZ First Credit Card. Enjoy $0 annual fee in the first year, plus amazing cardholder benefits!

Keep Reading

ANZ First Credit Card Review: Smart Financial Choices

Explore the ANZ First Credit Card's benefits and limitations in our detailed review. $0 annual fee in the first year! Read on and learn more!

Keep Reading