Credit Cards

OpenSky® Secured Visa® Credit Card review

Learn why the OpenSky® Secured Visa® Credit Card is one of the best credit building cards in the market in our full review!

Advertisement

OpenSky® Secured Visa® Credit Card: Build credit fast and improve your finances!

Are you in the market for a solid card to help you build your credit score? Then check out our OpenSky® Secured Visa® Credit Card review and learn why this is one of the best options out there.

OpenSky® Secured Visa® Credit Card: how to apply

Learn how to quickly and easily apply for the OpenSky® Secured Visa® Credit Card and start improving your credit score today!

Not only is this card easy to qualify for, but it offers exclusive benefits to its cardholders. You can get a credit limit increase, upgrade to an unsecured card, and more.

| Credit Score | No credit, Poor, and Fair. |

| Annual Fee | $35. |

| Purchase APR | 29.99% variable. |

| Cash Advance APR | 29.99% variable. |

| Welcome Bonus | None. |

| Rewards | There are no rewards on purchases. |

OpenSky® Secured Visa® Credit Card overview

If you’re looking to rebuild your credit score, getting a secured card is a solid alternative. And one of the best currently available is the OpenSky® Secured Visa® Credit Card.

With this card, there are no credit checks, and you can find out instantly whether you got it or not. That being said, the OpenSky® has one of best approval rates out there, with over 85%.

The card charges a modest $35 annual fee, and has a variable 29.99% APR on purchases and cash advances. There’s also a late payment fee up to $40.

You can deposit any amount between $200 and $3,000 – which will work as your spending limit. With on-time payments and responsible use, you may be eligible for a line increase without a deposit.

The OpenSky® Secured Visa® Credit Card offers credit bureau reporting, and even the chance to upgrade to an unsecured card in as little as 6 months.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

OpenSky® Secured Visa® Credit Card main features

The OpenSky® Secured Visa® Credit Card is a fantastic option to help you on your credit building journey.

But as with any credit card, there are a couple of drawbacks to consider before applying. See the pros and cons next in our OpenSky® Secured Visa® Credit Card review.

Pros

- No annual fee.

- No credit check to apply. Find out instantly if you are approved- Zero credit risk to apply!

- Looking to build or rebuild your credit? 2/3 of cardholders receive a 48+ point improvement after making 3 on-time payments.

- Get considered for an unsecured credit line increase after 6 months – no additional deposit.

- Monitor your credit progress with free access to your FICO Credit Score.

- Reports to all 3 major credit bureaus monthly to establish and build credit history.

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay.

- Secure your credit line with a refundable security deposit – as low as $300.

- Easy application, apply in less than 5 minutes right from your mobile device.

- Offer flexible payment due dates which allow you to choose any available due date that fits your payment schedule.

- Now you can make smaller partial payments towards funding your security deposit over 60 days.

- Over 1.2 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit.

Cons

- It has an annual fee.

- Requires a minimum $200 deposit.

- No welcome bonus.

- No rewards.

Minimum credit score to apply

Since this is a secured credit card for people who are looking to improve their credit, there are no minimum score requirements.

How to apply for the OpenSky® Secured Visa® Credit Card?

The OpenSky® Secured Visa® Credit Card could be the tool you need to start improving your finances! If you’d like to learn how to apply for it, check the following link.

OpenSky® Secured Visa® Credit Card: how to apply

Learn how to quickly and easily apply for the OpenSky® Secured Visa® Credit Card and start improving your credit score today!

About the author / Giovanna Klein

Trending Topics

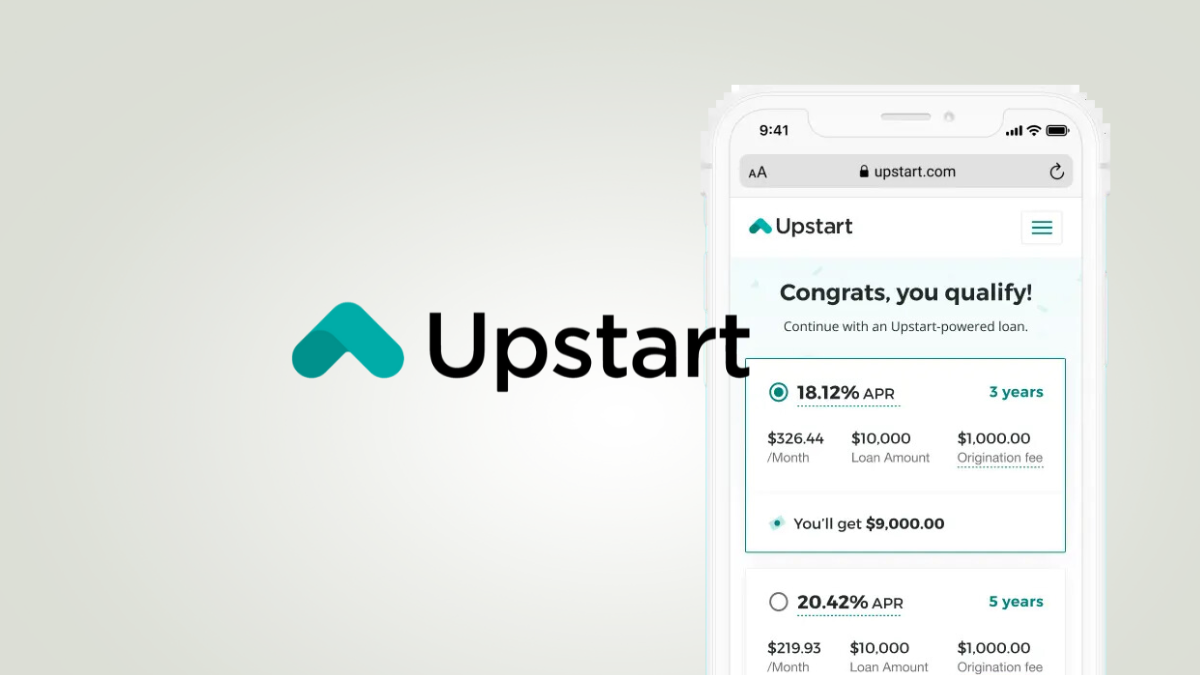

Find financial freedom: Upstart Loan review!

Do you need a loan to upgrade your finances with up to $50,000? If so, you can read on for our Upstart Loan review!

Keep Reading

Earn up to 5% back: Sam’s Club® Mastercard® review

If you're looking for a credit card that can give you cashback and exclusive perks, check this Sam’s Club® Mastercard® review!

Keep Reading

1.5% cash back: Capital One QuicksilverOne Cash Rewards review

Did you know you can build credit with a rewards card? Check this Capital One QuicksilverOne Cash Rewards review and understand how it works.

Keep ReadingYou may also like

How to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card

See how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and earn cash back while you build credit!

Keep Reading

Homeowner’s Tax Benefit: A Golden Opportunity

Explore the homeowner's tax benefit! From mortgage deductions to energy credits, discover how owning a home can save you money.

Keep Reading

LendingClub Personal Loans: all you need to apply

Learn now how to apply for a LendingClub Personal Loans. Qualify with fair credit and enjoy personalized rates! Keep reading for more!

Keep Reading