Credit Cards

Budget-Friendly and User-Focused: St.George Vertigo Card review

Discover the ins and outs of the St.George Vertigo Card in our review. Is this credit card the budget-friendly solution you've been looking for?

Advertisement

A Detailed Review of the St.George Vertigo Card

The St.George Vertigo Card is like that dependable friend you can always count on – and that’s what we’ll show in this review.

Simplicity Meets Savings: Apply for the St.George

Ready to simplify your finances? Learn how to apply for the St.George Vertigo Card – enjoy up to 55 days interest-free! Read on!

So, keep reading and discover the ins and outs of this credit card and whether this is the right product for you! Then let’s go!

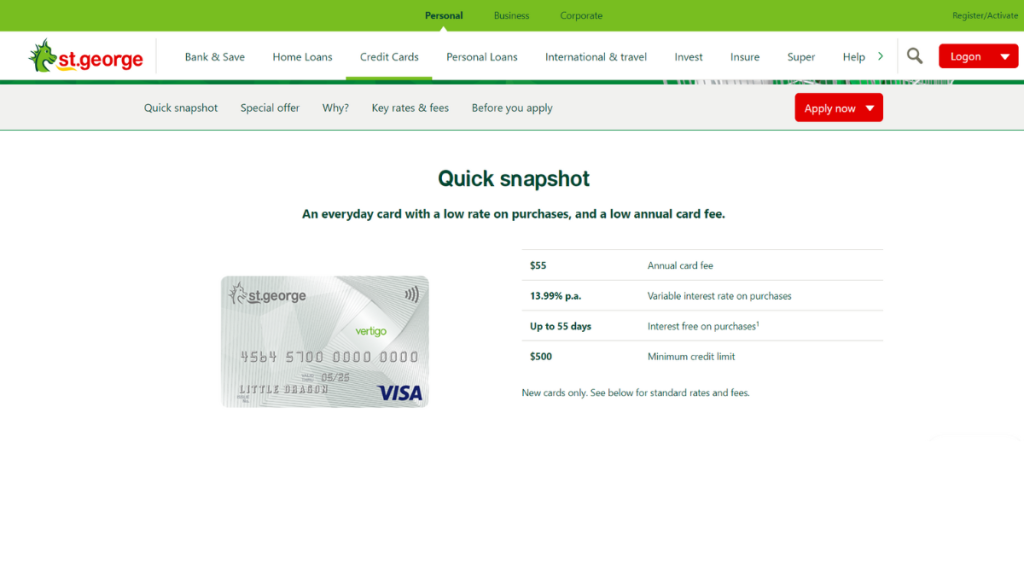

| Annual Fee | There is a $55 annual card fee. |

| Purchase Rate | 13.99% p.a. variable interest rate on purchases. |

| Interest-Free Period | Up to 55 days interest-free. |

| Minimum Credit Limit | You can get a $500 minimum credit limit. |

| Credit Score | You’ll need a good credit score and your finances in good standing to have more chances to qualify for this card. |

| Rewards | You can choose between the cash back perks card option and the balance transfer features discount option. |

St.George Vertigo Card overview

Indeed, this card is designed to make your financial journey smoother, more predictable, and, most importantly, budget-friendly.

Moreover, with a low annual fee and competitive interest rates, this card doesn’t break the bank just to be your trusty sidekick.

Also, it has a generous interest-free period on purchases. Also, this allows you to make those larger buys without sweating over immediate repayment.

Additionally, the card offers optional insurance coverage, adding an extra layer of security to your purchases.

So whether you’re looking to make everyday transactions or have a reliable credit option for emergencies, the St.George Vertigo Card can be great!

You will be redirected to another website

St.George Vertigo Card main features

It’s a credit card that doesn’t overcomplicate things – it’s simply here to help you keep your finances on track with ease and simplicity.

Moreover, if you’re looking for an everyday credit card that’s got your back, the St.George Vertigo Card is a strong contender.

However, this card also has some downsides. Therefore, read our pros and cons list below to learn more about it!

Pros

The St.George Vertigo Card comes with a competitive annual fee, making it an affordable choice for those looking to keep their credit card costs in check.

Also, this card offers a generous interest-free period on purchases, allowing you to make significant transactions without worrying.

Cons

While this card focuses on simplicity, it may not be the best choice for those seeking an extensive rewards program with cashback or points.

Moreover, the St.George Vertigo Card does not typically offer introductory interest-free periods or bonus rewards for new cardholders.

Also, when used overseas, this card may come with foreign transaction fees, which can add to the cost of international purchases.

Minimum credit score to apply

There is little information about the minimum credit required to apply for this card.

However, we recommend you have your finances in good standing before applying.

How to apply for the St.George Vertigo Card?

In summary, the St.George Vertigo Card is an excellent option for those who value simplicity and budget-friendly features in a credit card.

However, it may not be the best fit for individuals seeking robust rewards programs or frequent international travelers due to foreign transaction fees.

But how to apply for it? You can read our blog post below to learn all about how the application process works for this card!

Simplicity Meets Savings: Apply for the St.George

Ready to simplify your finances? Learn how to apply for the St.George Vertigo Card – enjoy up to 55 days interest-free! Read on!

About the author / Victoria Lourenco

Trending Topics

Apply for HSBC Low Rate Card: Unlocking Financial Freedom

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Learn the step-by-step application process!

Keep Reading

Simplicity Meets Savings: Apply for the St.George Vertigo Card

Ready to simplify your finances? Learn how to apply for the St.George Vertigo Card - enjoy up to 55 days interest-free! Read on!

Keep Reading

ANZ First Credit Card Review: Smart Financial Choices

Explore the ANZ First Credit Card's benefits and limitations in our detailed review. $0 annual fee in the first year! Read on and learn more!

Keep ReadingYou may also like

Apply for ANZ First Credit Card: Your Key to Financial Freedom

Learn the easy steps to apply for the ANZ First Credit Card. Enjoy $0 annual fee in the first year, plus amazing cardholder benefits!

Keep Reading

A Step-by-Step Guide: Applying for the ANZ Low Rate Credit Card

Discover the hassle-free way to apply for the ANZ Low Rate Credit Card with our step-by-step guide. Get the card that helps you save!

Keep Reading

Westpac Low Rate Card review: Is it Worth It?

Is this card your ideal financial companion? Read on to find out in our Westpac Low Rate Card review! Up to 55 interest-free days!

Keep Reading